DFDL Myanmar Holds Webinar on Tax Updates & Outlook for 2021

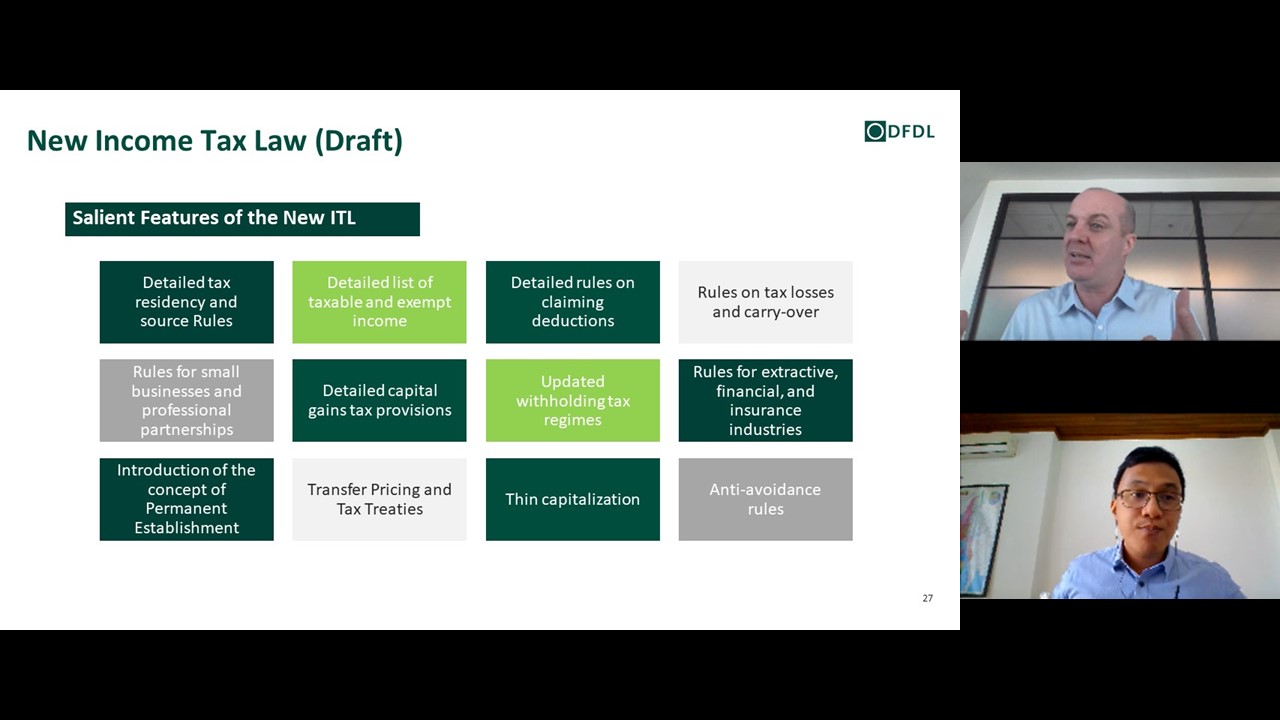

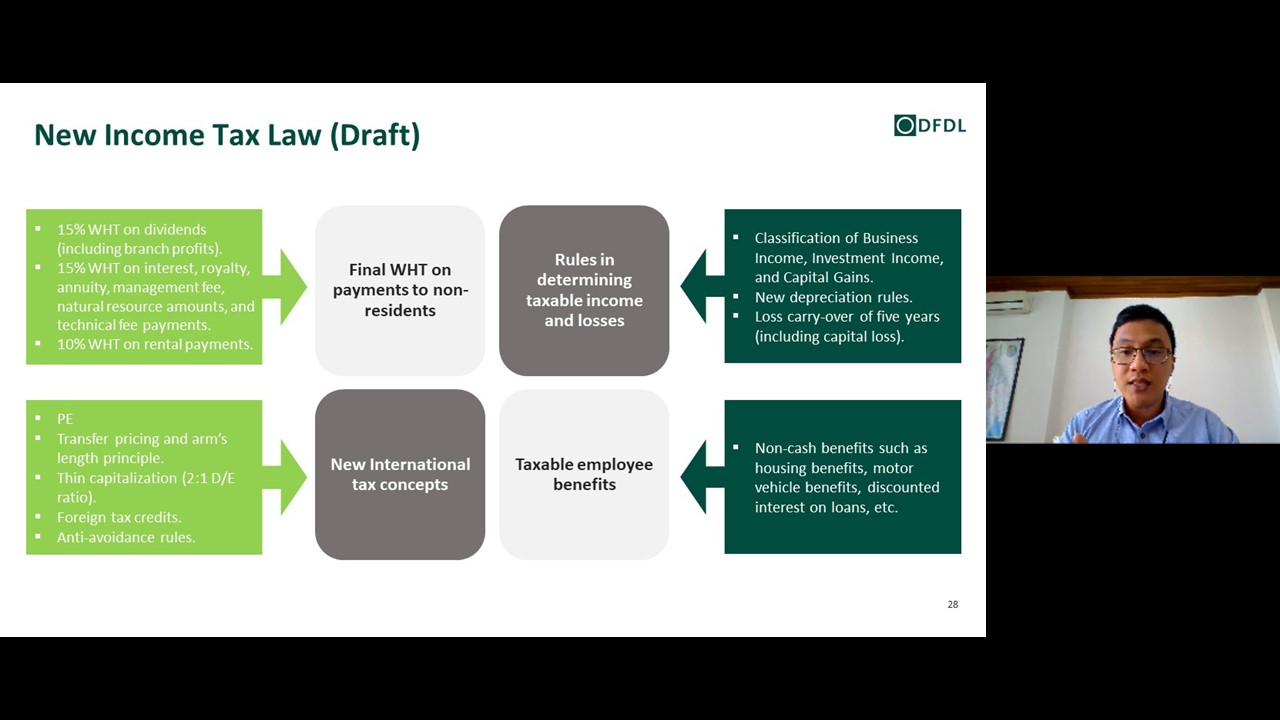

On 26 November 2020, the DFDL Myanmar tax team organized a well-attended webinar on tax updates, urgent end-of-year filing obligations and the outlook for 2021. Jack Sheehan (Partner & Head of Regional Tax Practice), Diberjohn Balinas (Senior Tax Manager) and Nay Nay Eaint (Tax Manager) shared their insights and expertise with the audience on key recent changes to Myanmar tax laws, changes to tax administration procedures and important filing requirements. With Jack moderating this live event, Diberjohn discussed important tax compliance obligations with a special outline on tax deductible expenses, available COVID-19 tax relief, required documents for submission and other key compliance issues and tax filing obligations. He also gave an insightful overview of recently issued tax laws and outlined the key changes under the draft new income tax law. Nay Nay’s speech focused on tax administration procedural updates and tax e-filing and e-payment procedures. The webinar concluded with an active and insightful Q&A session.

26 November 2020 | 10:00 – 11:30 am (UTC +6:30) | Complimentary

Keep up with all the key 2020 tax developments in Myanmar by joining DFDL for this informative half morning webinar on 26 November 2020.

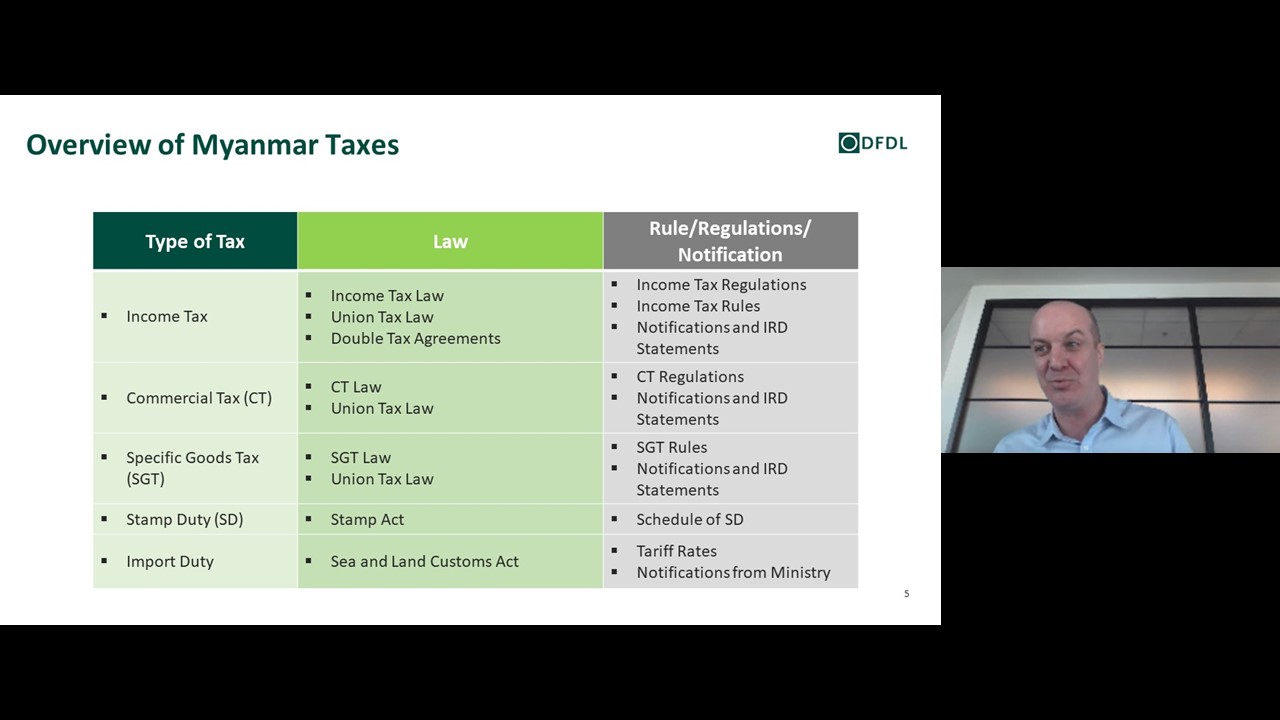

At this event, our dedicated tax professionals will discuss and outline key recent changes to Myanmar tax laws, including the 2020 Union Taxation Law, new tax notifications (especially those related to easing tax burdens and filing requirements due to COVID-19), changes to tax administration procedures and other important updates from the Internal Revenue Department.

We will also lead a comprehensive discussion on your tax compliance obligations in Myanmar, especially on the annual tax reporting requirements for the financial year ending 30 September 2020 that are due by 5 January 2021. Here we will outline tax deductible expenses, available COVID-19 tax relief, required documents for submission and other key compliance issues and tax filing obligations that companies must keep track of when doing business in Myanmar in order to avoid unnecessary penalties, business interruptions and potential tax re-assessments.

Don’t miss out on this opportunity to hear from our experts!

Agenda

- 10:00 – 10:45 am: Recent Developments in Myanmar Taxation

- 10:45 – 11:15 am: Discussion of Year-End Tax Compliance Requirements

- 11:15 – 11:30 am: Q&A Session

Click here to register

Speakers

|

|

|

|

Partner & Head of the Regional Tax Practice |

Senior Tax Manager, Myanmar |

Tax Manager, Myanmar |