DFDL Hosts Cambodia Tax on Income Updated Rules 2020 Webinar

On 3 December 2020, DFDL Cambodia’s Tax Team organized and hosted a well-attended (with over 260 attendees) webinar on ‘Tax on Income Updated Rules 2020’. Sokheng Say (Partner and Head of Regional Accounting Advisory Practice), Borapyn Py (Partner and Cambodia Deputy Head of Tax Practice) and Vajiravann Chamnan (Cambodia Senior Tax Manager) shared their insights and expertise with the audience on the key tax updates and new rules concerning Tax on Income. With Sokheng Say moderating this live event, Borapyn Py’s speech focused on the key tax updates that occurred over the course of 2020. He started out with an overview of the COVID-19 tax relief measures. He then went on to discuss other recent developments and changes in taxation. These included: reduced withholding tax on interest payments to resident and non-residents lenders, advanced tax on dividend distributions, tax on salary for seniority payments, securities sector tax incentives, VAT on the disposal of assets, and capital gains tax. Vajiravann Chamnan then provided an overview of the new income tax rules and updates. She also discussed key changes concerning the treatment of taxable income, what constitutes deductible and non-deductible expenses and concluded with a detailed high-level walkthrough on calculating Tax on Income. The webinar concluded with an active, interactive and insightful Q&A session. If you missed our webinar and want to access the replay, please send us an email at events.cambodia@dfdl.com.

3 December 2020 | 09:00 – 11:30 am (UTC+07:00) | Complimentary

DFDL cordially invites you to the upcoming Cambodia Tax on Income Updated Rules 2020 webinar on Thursday, 3 December 2020.

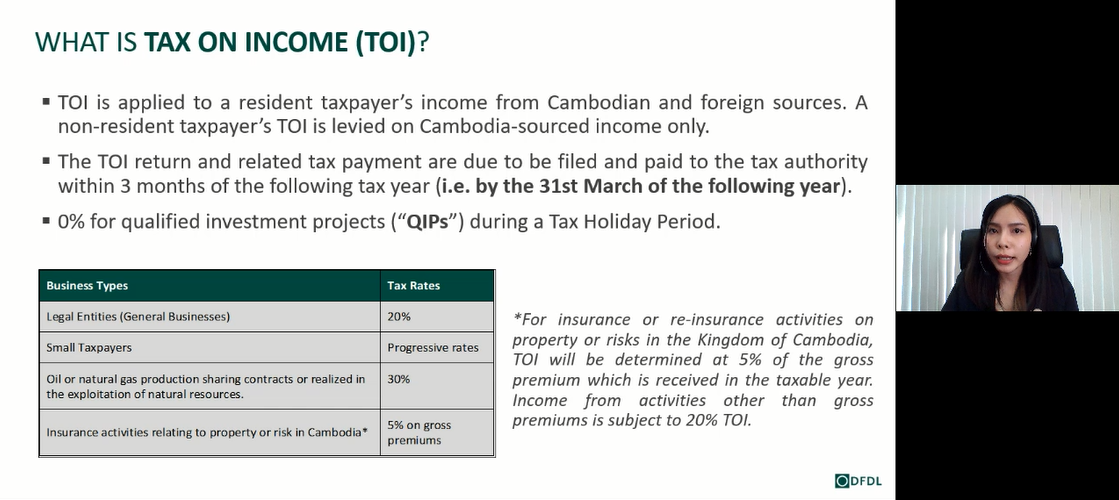

On 29 January 2020, the Ministry of Economy and Finance issued Prakas No. 098 MEF.Prk (“TOI Prakas”) outlining new rules and updates in regard to Tax on Income (“TOI”). The TOI Prakas has introduced a number of changes concerning the treatment of taxable income and what constitutes deductible and non-deductible expenses among others. The changes outlined in the Prakas give rise to new ramifications regarding the preparation of end-of-year TOI returns for 2020 which will impact all taxpayers subject to the self-assessment regime.

In light of these developments the objective of the webinar is for our experts to bring taxpayers up to speed on the key new changes as the TOI filing deadline draws near. We will also briefly discuss the key tax updates that have occurred in 2020.

Don’t miss out on this opportunity to hear from our experts!

Agenda

- 09:00 – 09:10 am: Opening Remarks – Sokheng Say (Partner & Head of Regional Accounting Advisory Practice)

- 09:10 – 09:30 am: Key Tax Updates in 2020 – Borapyn Py (Partner & Deputy Head of Cambodia Tax Practice)

- 9:30 – 10:30 am: Updated Rules per the TOI Prakas – Vajiravann Chamnan (Senior Tax Manager)

- 10:30 – 11:20 am: Q&A Session – Borapyn Py and Vajiravann Chamnan

- 11:20 –11:30 am: Closing Remarks – Sokheng Say

Moderator & Speakers

|

|

|

|

Sokheng Say |

Borapyn Py |

Vajiravann Chamnan Senior Tax Manager |