As Myanmar continues to attract the attention of the international business community, in this tax update we will look at the corporate and personal tax compliance obligations and tax planning for international companies and individuals doing business in Myanmar.

Corporate Income Tax (“CIT”)

- A company formed under the Myanmar Companies Act (the “Companies Act”); or

- A company formed under any other existing law of Myanmar, including the Special Company Act (company with State equity) and the FIL.

Resident companies are subject to tax on income accrued, or derived from, or received from any sources in and outside Myanmar. Non-residents are liable to tax on Myanmar-sourced income only.

The tax year in Myanmar is from 1st April to 31st March. Annual CIT returns are due by 30th June after the end of the tax year.

CIT payments must be made in advance either monthly or quarterly and based on the estimated total income for the year. If at the end of the tax year, the company has made a loss or has paid more tax than the estimated tax, the excess amount can be carried forward to be used against tax payable in the following year or the taxpayer apply for tax refund from the IRD.

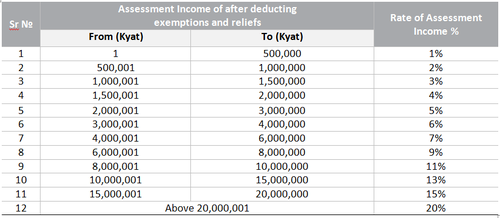

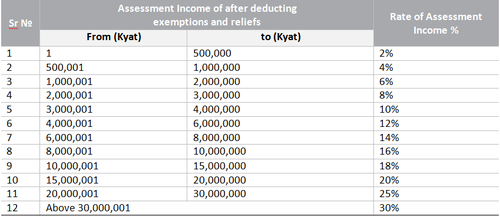

Personal Income Tax (“PIT”)

Income tax is levied on resident and non-resident individuals. Foreigners who reside in Myanmar for at least 183 days during an income year (1 April to 31 March) are considered resident foreigners. If the foreigner works for a foreign invested enterprise under the FIL, the foreigner is automatically treated as a resident foreigner irrespective of period of stay in Myanmar.

Residents are subject to income tax on all income derived from sources within and outside of Myanmar. Non-resident foreigners are taxed only on income derived from sources within Myanmar.

Tax on salary, includes perquisites (benefits) in cash or in kind. For instance, the rental value of free accommodation is usually calculated at 10% of the employee’s gross salary or at 12.5% if the accommodation is furnished. If the employer pays the employee’s tax, a tax on tax basis of assessment in adopted.

- Basic relief of 20% of total income, up to a maximum of MMK 10,000,000;

- Spouse relief of MMK 300,000, provided the spouse has no assessable income;

- Life insurance payments on taxpayer and spouse;

- Child relief of MMK 200,000 per child for any unmarried child who is below 18 years of age. If a child is above 18 years of age, he must be receiving full-time education.

Income from profession, business, property and other sources not exceed 1,200,000 kyats per year shall not be subject to PIT. Capital gains from within one year is not exceeding 5,000,000 kyat shall also not be subject to PIT.

Non-resident foreigners shall be subject to PIT of 35% on Myanmar sourced income only.

Tax shall be paid in Kyats for citizens and resident foreigners, except for capital gains which are taxable using the transaction currency. PIT of non-resident foreigners shall be paid as foreign currency.

The employer is responsible for withholding and claiming deductions on the income tax on salary at the time of payment to employees. A statement of monthly deductions must be furnished to the revenue office within 7 days from date of deductions. The employer must also provide an annual finalization statement of salaries paid to employees.

Capital Gains Tax (“CGT”)

Gains from the sale, exchange or transfer by any means of capital assets, in MMK or foreign currency, are taxed at the rate of 10%, if the proceeds of all assets disposed exceed MMK 5,000,000. In the case of a non-resident foreigner, the tax rate of 40% is to be paid in the same currency as the disposal or transfer transaction.

Companies carrying on business in the oil and gas sector in Myanmar are taxed at a progressive rate from 40% to 50% on gains realized from the sale, exchange or transfer by any means, of any capital assets including shares, capital assets, ownership and benefits.

Tax returns on capital assets must be filed within 1 month from date of disposition or transfer.

Undisclosed Income

Any immovable property or movable property including money for which the person concerned is unable to account for accurately as to how he has acquired the property, shall be considered undisclosed income and it shall be subject to 30% for assessment income.

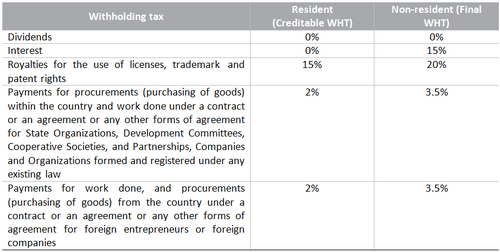

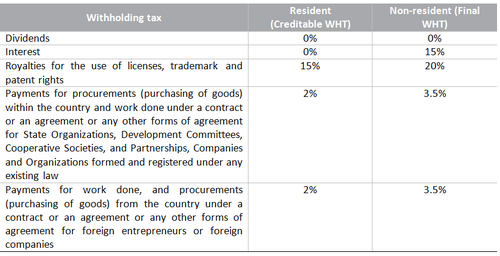

Withholding Tax (“WHT”)

The assessment of withholding tax on a non-resident foreigner is a final assessment.

The WHT shall be remitted to the tax authority within 7 days from the date of the transaction and a WHT Certificate shall be issued to payee.

Double Tax Agreements (“DTAs”)

Myanmar has signed DTAs with UK, India, Bangladesh, Singapore, Vietnam, Malaysia, Republic of Korea, Thailand and Laos. DTAs can offer a reduction in WHT rates.

Dividends are not subject to withholding tax in Myanmar and therefore no further benefit can be obtained under a DTA.

- Singapore: Limited to 8% of gross interest if received from bank or financial institution, or 10% in all other cases.

- India: Limited to 10% of gross interest.

- UK: No reduction.

- Thailand: Limited to 10% of gross interest.

- Vietnam: Limited to 10% of gross interest.

- Malaysia: Limited to 10% of gross interest.

- Republic of Korea: Limited to 10% of gross interest.

- Laos: Limited to 10% of gross interest.

- Singapore: Limited to 10% for patent, design, plan, secret formula, or right to use equipment or information concerning industrial, commercial or scientific experience, and 15% for all other royalties.

- India: Limited to 10% of gross Royalty.

- UK: Royalties are exempt up to an amount considered fair and reasonable consideration for the rights for which the royalties are paid. Note this does not include amounts paid in respect of the operation of a mine or quarry or of other extraction of natural resources, or rent or royalties in respect of a motion picture film.

- Thailand: Limited to 5% for copyright, 10% for management and consultancy services transfer of knowhow and 15% for all other Royalties.

- Republic of Korea: Limited to 10% for any patent, design or model, plan, secret formula or process or f

or the use of or the right to use, industrial, commercial or scientific equipment, 15% for all other Royalties. - Vietnam: Limited to 10% of gross Royalty.

- Malaysia: Limited to 10% of gross Royalty.

- Laos: Limited to 10% of gross Royalty.

Commercial Tax (“CT”)

There is no Value Added Tax (“VAT”) system in Myanmar. However, there is a Commercial Tax (“CT”) imposed on various items as set out in various schedules in the CTL. CT applies to goods produced in Myanmar, services rendered in Myanmar and goods imported into Myanmar that are listed in the CTL’s schedules.

The CT is payable on a monthly basis before the 10th of the month following the month of the sale. A quarterly and an annual return for CT are to be filed within 1 month from end of the quarter and within 3 months of the end of year, respectively.

Commercial tax is also levied on imported goods based on the landed cost, which is the sum of CIF value, port dues calculated at the rate of 0.5% of CIF value of goods, and customs duties. Collection is made at the point of entry and time of clearance, along with customs duties.

While Commercial Tax is not a Value Added Tax with full credits available, there is a partial offset system for trading of goods and services, when the tax is shown on supplier invoices and other requirements are met.

Customs and Import Duties

In line with the latest Customs Tariff of Myanmar, customs duty is payable according to the tariff schedules based on assessable value. Rates range from 0% to 40%. Cars, luxury items, and jewellery are subject to the highest rates.

According to the FIL, exemption or relief from customs duties may be granted on machinery, equipment, components, spare parts, and materials imported for use during the construction period for a company receiving benefits under the FIL. Similar exemption or relief may be granted for such companies on raw materials imported in the first three years of commercial production. The Sea Customs Act, 1878, inter alia, makes provision for refunds. For example, it provides that seven-eighths of the customs duty paid on goods will be refunded when such goods are withdrawn from the country again under a drawback facility.

Myanmar Stamp Act

Stamp Duties are collected from the sale of judicial and non-judicial stamps. Judicial stamps are supplied for use in judicial proceedings while non-judicial stamps are for general purposes.

Judicial Stamp Duty is collected from sale of judicial stamps and represents fees payable under the Court Fees Act. The rates are varied depending on the subject matter of the document. Taxable documents include complaints, probates of a will, letters of administration, succession certificate, petitions, application for leave to sue, memorandum of appeal, bail-bond, etc..

Non-Judicial Stamp Duty is levied on various kinds of instruments, which are required to be stamped under the Myanmar Stamp Act. Instruments chargeable to duty and the corresponding rates that are mentioned in schedule annexed to the Act.

Stamp duties are generally due at the time of the execution of the documents.

Tax labels

There is need to attach tax labels on certain goods such as Liquor, Beer, Wine, Cigarette and Purified Water. There are two types of labels: one for imported goods and other is for locally produced goods.

Property Tax

Foreign companies are prohibited from owning immovable property in Myanmar, hence property tax would not be relevant to foreign investors.

- General tax not exceeding 20% of annual value;

- Lighting tax not exceeding 5% of annual value;

- Water tax not exceeding 12% of annual value; and

- Conservancy tax not exceeding 15% of annual value.

The “annual value” pertains to the gross annual rent for which the land and building may be expected to be leased unfurnished. It also includes the value of result of a percentage determined by the Yangon City Development Committee from time to time on the value of property to be taxed.

We trust you find our tax updates useful and we welcome your questions and feedback. Please contact [email protected] or Bernard [email protected] for further information on how DFDL can assist you with tax planning and compliance in Myanmar.

To download this article in PDF, please Click Here.