On 25 April 2023, the Ministry of Planning and Finance (“MOPF”) issued a new Standard Operating Procedure (“SOP”) outlining the additional tax requirements when remitting foreign currency payments from Myanmar to overseas. This SOP is effective on 1 May 2023 and applies to individuals, companies, and organizations that are transferring foreign currency payments exceeding USD 10,000 (or its equivalent).

Requirements of the Taxpayer

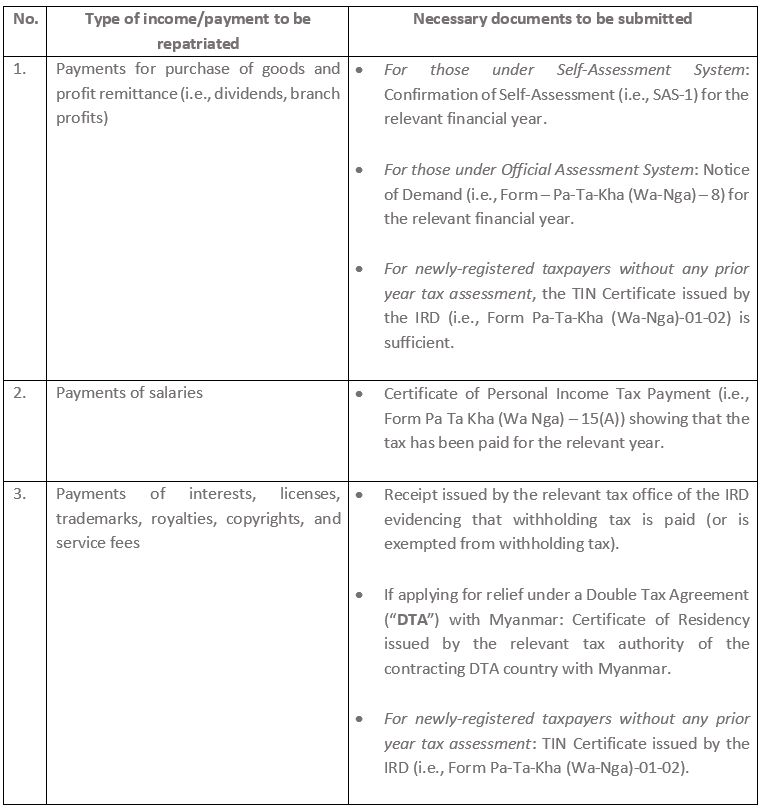

Referring to the SOP and based on a May 2023 Announcement from the Internal Revenue Department (“IRD”), the taxpayer will now be required to provide the following documents to its authorized dealer (“AD”) Banks before such payments can be repatriated overseas:

Requirements of AD Banks

Under the SOP, AD Banks are entrusted with reviewing and verifying the documents submitted by the taxpayer before they can clear the remittance payment. AD Banks will verify whether such payments are supported by the relevant tax forms for the respective years (as discussed above).

Responsibilities of the IRD

Under the SOP, the IRD is responsible for issuing relevant documents (e.g., evidence of withholding tax payment or exemption) to the taxpayer with regard to payments of interest, trademarks, copyrights, and service fees. In addition, the IRD is also responsible for answering any question that the AD Banks or remitting taxpayers might have concerning tax procedures.

DFDL Comments

The issuance of the MOPF’s SOP is a way to cross-check the tax compliance of taxpayers who are planning to remit foreign currency payments. As AD Banks will now be required to inspect these documents, taxpayers should be mindful to ensure that they have the relevant tax documents as prescribed in the SOP. This includes assessing their compliance with tax registration, tax filing and payment, and securing the relevant tax clearances or assessments from their relevant tax office.

Apart from these tax requirements, it is also important to note that foreign currency remittances (as applicable) remain to be subject to approval from the Foreign Exchange Supervisory Committee (“FESC”) of the Central Bank of Myanmar.

The information provided here is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.