On 5 August 2019, the Ministry of Planning and Finance (“MOPF”) issued Notification 64/2019 (“Notification 64”) that provides the procedures on the collection and assessment of taxes for the six-month transition period starting 1 April to 30 September 2019. This Notification, which is in accordance with Section 40 of the 2018-2019 Union Taxation Law and is in line with the MOPF announcement on the change in financial year last 28 May 2019, outlines the tax procedures applicable to all taxpayers (except for state-owned enterprises) that have yet to adopt the new financial year starting 1 October 2019.

Notification 64 covers matters relating to the determination of tax exemption thresholds, the determination of residency for this six-month period, and the manner of calculating corporate and personal income taxes, among others. We provide the salient features of the Notification below:

Determination of Tax Exemption Thresholds

Under Notification 64, taxpayers may be exempt from the payment of taxes provided that the equivalent revenue, income or sales during the six-month period fall within the tax exemption thresholds as stated in the 2018-2019 Union Taxation Law. The Notification provides the manner of determining these thresholds for specific goods tax (“SGT”), commercial tax (“CT”), personal income tax (“PIT”), corporate income tax (“CIT”), and capital gains tax (“CGT”). Similarly, the Notification also provides the criteria to determine the tax thresholds applicable to small-and-medium enterprises (“SMEs”).

| Tax Type | Exemption thresholds under 2018-2019 Union Taxation Law | Manner of determining the thresholds under Notification 64 |

| SGT | MMK 20 million of the total annual sales from local production and sale of tobacco leaf, cheroots and cigars |

Total revenue from 1 April to 30 September 2019 to be multiplied by 2. [a] Exempt from SGT if [a] ≤ MMK 20 million. |

| CT | MMK 50 million of the total annual sales |

Total sales proceeds or revenue from 1 April to 30 September 2019 to be multiplied by 2. [b] Exempt from CT if [b] ≤ MMK 50 million |

| PIT | MMK 4.8 million of the total annual income (under the heading of salary) |

Total income received by the individual from 1 April to 30 September 2019 to be multiplied by 2. [c] Exempt from PIT if [c] ≤ MMK 4.8 million |

| CIT | MMK 10 million of the total annual income for SMEs (if the six month period is within the first three years of commencing operations) |

Total income received by SMEs from 1 April to 30 September 2019 to be multiplied by 2. [d] Exempt from CIT if [d] ≤ MMK 10 million |

| CGT | MMK 10 million of the total annual value of the sale or transfer of capital assets | Based on the total value of sale or transfer of capital assets from 1 April to 30 September 2019. |

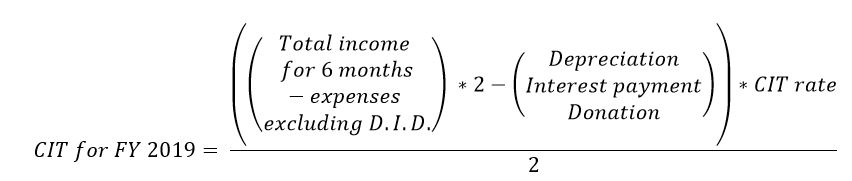

Calculation of CIT

Notification 64 provides the methods of calculating CIT for MIC-registered entities, companies, and cooperatives.

Step 1: Total income received from 1 April to 30 September 2019 will be reduced by the expenses incurred for the related period. However, the expenses to be deducted exclude depreciation, interest, and donations. These expenses will be considered only after the average annual net income is determined.

Step 2: Total net income after the deduction in Step 1 will be multiplied by two in order to determine average annual income. In the case of SMEs, only profits in excess of MMK 10 million will be subject to CIT.

Step 3: Total average annual income in Step 2 will be reduced by the allowable tax depreciation (under Notification 19/2016) and the actual interest payment for the period.

Step 4: Adjusted average annual income as determined in Step 3 will be reduced by donations. Such donations will be subject to the 25% limit of total net income per Section 6 of the Income Tax Law.

Step 5: The adjusted annual income in Step 4 will be multiplied by the CIT rate applicable to the taxpayer.

Step 6: The CIT due as calculated will be divided by two in order to determine the applicable tax for the transitional period 1 April to 30 September 2019.

To summarize our understanding:

DFDL’s view:

- The manner of calculating the tax under Notification 64 is not consistent with the approach previously used by the MOPF in Notification 72/2018 (“Notification 72”) dated 5 September 2018. Notification 72 addressed the transitional procedures when this change in financial year was first introduced for state-owned enterprises last October 2018. Under the previous Notification, the tax will be based on the actual income and expenses for the six-month period (instead of using estimated annual income) where the depreciation allowed to be claimed only relates to the six-month period (not based on full year depreciation). However, the new Notification 64 calculates the tax on the basis of estimated average annual income with qualifications as to the allowable deductions on depreciation, interest, and donations. Likewise, the estimated annual tax is divided by two in order to determine the due tax for the six-month period.

- Notification 64 qualifies that only actual interest payments are deductible for CIT. It can be interpreted that the taxpayer may not be able to claim a tax benefit on accrued interest expenses recognized for the six-month transitional period. Another issue with this is in regard to the mismatch in the recording of expenses as it will only take into account the actual interest payment made for the six-month period, as compared to other expenses which are estimated based on a 12-month period. Thus, the use of actual interest payment covering only the six-month period could potentially result in a higher CIT payment due to a lower deductible interest being allowed for CIT reporting.

- Notification 64 does not provide guidelines on the treatment of taxpayers who are not earning income, who are in a net-loss position during the transitional period, and those who have carry-over losses from prior years. For example, it is not clear how depreciation will be calculated in this case as the MOPF’s procedures only address situations where the taxpayer is in a profitable position. In addition, the guidelines are also unclear on how to offset losses incurred in prior years for this transitional period. The Notification only indicates that the six-month period from 1 April to 30 September 2019 will be considered as one financial year for the purposes of determining the loss carry-over period. However, it remains unclear how past losses may be claimed as special deductions during the current transitional period. Further clarification is needed in this regard.

- It is not clear how the estimated annual income should be presented in the CIT returns. This could affect taxpayers under the self-assessment system where the current CIT return requires the taxpayer to disclose information on a per-line item.

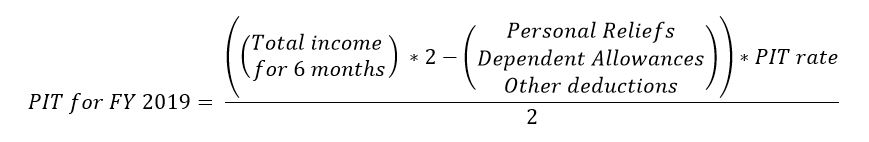

Calculation of PIT

Notification 64 provides the manner of calculating PIT for residents and non-residents. For the six-month period, a foreign national will be considered to be a Myanmar tax resident if his or her total number of days in Myanmar during the six month period as multiplied by two exceeds 183 days. As a resident, the foreign national will be taxed based on worldwide sources of income and will have a right to claim relief and deductions under the existing tax rules. Otherwise, the foreign national will be considered a non-resident and will be taxable only on Myanmar-sourced income without tax relief and deductions.

The PIT of taxpayers whose annual income exceeds MMK 4.8 million will be determined as follows:

Step 1: Total income received from 1 April to 30 September 2019 (under the heading of salary, profession, or business) will be multiplied by two to determine average annual income.

Step 2: Total average annual income as determined in Step 1 may be reduced by personal relief and allowances (e.g., spouse, parental, and children allowances), insurance, and social security contributions as provided under the Income Tax Law.

Step 3: The PIT will be calculated based on the progressive tax rates of 0-25% as mentioned in the 2018-2019 Union Taxation Law. The PIT due will further be divided by two in order to determine the tax applicable for the transitional period 1 April to 30 September 2019.

To summarize our understanding:

For taxpayers receiving rental income, the tax (at 10%) will be based on the average annual rental income (if the lease period is less than one year) or the total rental income (if the lease period is one year or more). In cases where the lease period does not exceed one year, the tax will be prorated based on the term of the lease divided by 12.

The manner of calculating the tax will also apply to partnership businesses and primary cooperative societies.

DFDL’s view:

- The approach of using a multiplier of two in determining the residency means that individuals staying in Myanmar for more than three months during the six-month period will be treated as tax residents and taxed on the basis of worldwide income.

- The approach of using a multiplier of two to determine the estimated annual income assumes that the individual will be receiving the same benefits for the next six months. However, the MOPF guidelines do not take into consideration one-time benefits (such as a bonus) and variable benefits that are not regularly given to employees. If the procedures under Notification 64 would be applied to one-time benefits and variable benefits (i.e. such benefit will be doubled in determining the estimated annual income), the taxpayer would potentially be exposed to higher levels of PIT for the six-month period.

- It is not clear whether the social security contribution (allowed as deduction) will be computed on an annual basis. Also, it is not clear how a taxpayer can avail of any exemption or potential relief under an existing Double Tax Avoidance Agreement with Myanmar during the transitional period.

Filing of annual tax returns

The annual corporate income tax return, annual salary statement, and annual commercial tax return for the short period ending 30 September 2019 must be submitted to the relevant tax authorities within three months from the end of the six-month period (i.e. on or before 2 January 2020).

Conclusion

The issuance of Notification 64 provides a better understanding how the taxes will be calculated for the six-month transitional period. However, certain matters remain that need further clarification by the IRD in order to effectively enforce such calculations. This includes the clarification on interest payments for CIT, the approach to be used for variable benefits with regard to PIT, and the treatment of carry-over losses as special deductions for this transitional period, among others. We hope that the IRD will shed more light on and clarify such issues before the end of the financial year so that taxpayers will be given sufficient guidance on the applicable tax procedures during the transitional period.

DFDL Contacts

Partner & Head of the Regional Tax Practice Group

Senior Tax Manager

DFDL Myanmar

The information provided in this email is for information purposes only, and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.