In the current Cambodian tax laws and regulations, there are a number of tax rules which pose problems or are difficult to interpret in case a company is listed on the CSX. In order not to pose an obstacle to the growth of the CSX, such rules should be clarified or amended for that situation. As international studies show, clear and coherent tax rules are more persuasive for foreign investors in Asia than temporary low rates .

Is a company’s loss carry forward cancelled in case of change in shareholders?

The Prakas on the Tax on Profit sets out a number of conditions for companies to be allowed to carry forward their tax losses. One of those conditions relates to the “identity of the enterprise.”

b. Identity of the enterprise:

b1- A loss is allowed to be brought forward for deduction from the realized results of one same enterprise only. In this: In the case where there is a change of owner, the loss sustained by the former owner cannot be brought forward for deduction against the profit of the new owner. The change of owner occurs mostly through the sale of the enterprise, the death of the owner and the business is taken over by the deceased’s heirs, …

This provision does not fit very well with the concept of a shareholding company. It is unclear from section 9.5. Prakas TOP whether a change in shareholders of a company would be deemed a “change of owner”. If it is, the company would no longer be allowed to offset its carried forward loss with new taxable income. This is a significant disadvantage for the company, and leads to the double taxation of business income.

Obviously, a company that has part of its shares publically traded may have changes in shareholders all the time.

It seems almost unavoidable that the rules in the Prakas TOP on loss carry forward are to be amended. Otherwise, the transfers of securities might be deemed a change of owner which may lead to cancelling of the loss carried forward.

What is the difference between resident and non-resident shareholders?

Cambodian tax rules impose a 14% dividend withholding tax on non-residents. Residents of Cambodia (both Cambodian nationals and foreigners that are residents of Cambodia) are not subject to this 14% withholding tax. Thus, the difference between “resident” and “non-resident” is quite important from a tax perspective.

“Residence” for tax purposes is not the same as for immigration or civil purposes. The tax regulations define “residence” for tax purposes as follows:

For a physical person, the term resident taxpayer refers to any physical person who has a residence, a principal place of abode, or who is present in the Kingdom of Cambodia for more than 182 days in any period of 12 months ending in the current tax year. The criteria for a residence in Cambodia are as below and any physical person who satisfies any one of the 3 criteria as below shall be considered a resident in the Kingdom of Cambodia.

a. The first criteria is determined by a physical person’s residence. A physical person has his residence located or situated in the Kingdom of Cambodia if he owns, rents, leases, or has available for use a house, apartment, dormitory, etc. in which he usually stays or occupies;

b. The second criteria is determined by a physical person’s principal place of abode in the Kingdom of Cambodia, which is a factual determination based on factors such as the physical person’s center of economic interest, the amount of time spent, the nature of time spent, where that person’s family resides, the physical person’s bank accounts are held, his main social activities take place.

c. The third criteria is the presence of the physical person in the Kingdom of Cambodia for more than 182 days during one or more separate periods in any period of 12 months ending in the current tax year. In determining the number of days in the Kingdom of Cambodia, presence for any part of a day is counted as a whole day.

Although this definition is quite clear, it may be difficult to apply in practice without some further measure of tax administration. For example, the company paying the dividend must be certain that the shareholder is a non-resident or a resident. Under the current rules that remains a matter of interpretation and appreciation of the facts. In hindsight, tax authorities may disagree with the company that a certain shareholder is a non-resident, and claim the withholding tax that the company did not withhold.

This uncertainty can be relieved by putting in place administrative measures to clarify the residence of individual shareholders.

Which taxes apply to a buy-back of shares?

Listed companies often purchase some quantity of their own shares. They may hold the shares for a limited period of time or cancel the shares in certain circumstances.

Cambodia’s tax rules are unclear as to which taxes apply to this relatively common operation. There is a 14% withholding tax on dividends paid to foreign residents (see below) but the definition of dividend does not include a premium paid by the company that redeems its own shares. As a result, it is unclear if taxpayers can buy-back shares without any taxes.

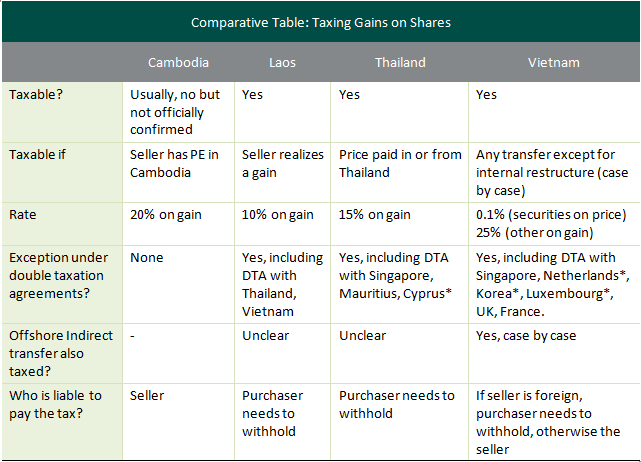

Taxation of capital gains on shares listed on the CSX

In my view, under the current status of Cambodian tax law a non-resident that realizes a capital gain on shares in a Cambodian company is not subject to tax. This can be concluded from the combined interpretation of Art. 26, Art 33 and Art 107 Law on Taxation, particularly since Art. 7 Law on Taxation has introduced a capital gains tax that is for the moment not implemented. However, this view has not been officially confirmed by the General Department of Taxation. Thus, there is some uncertainty in this matter although in practice it is clear that no such taxes are claimed by authorities or declared by taxpayers.

For non-resident investors in the CSX, it is crucial to determine the net-profit that they can derive from investing in listed shares. Thus, it must be clear which Cambodian taxes will apply to the purchase and resale of shares.

Foreign investors that consider the CSX will certainly appreciate if the capital gains issue is clarified.