On 6 June 2023, the Royal Government of Cambodia issued Sub-Decree 122 on the Adjustment to Customs Tariff, Specific Tax, and Export Tax Rates on certain goods.

The Sub-Decree 122 aims to address inflation and promote trade activities in Cambodia. The tariff changes will focus on accelerating the development in the priority sectors such as agriculture, transportation, health, education, industry and production, and environmental protection. The Sub-Decree will be effective starting 1 July 2023.

The following are the key changes in tariff and rates under the Sub-Decree 122:

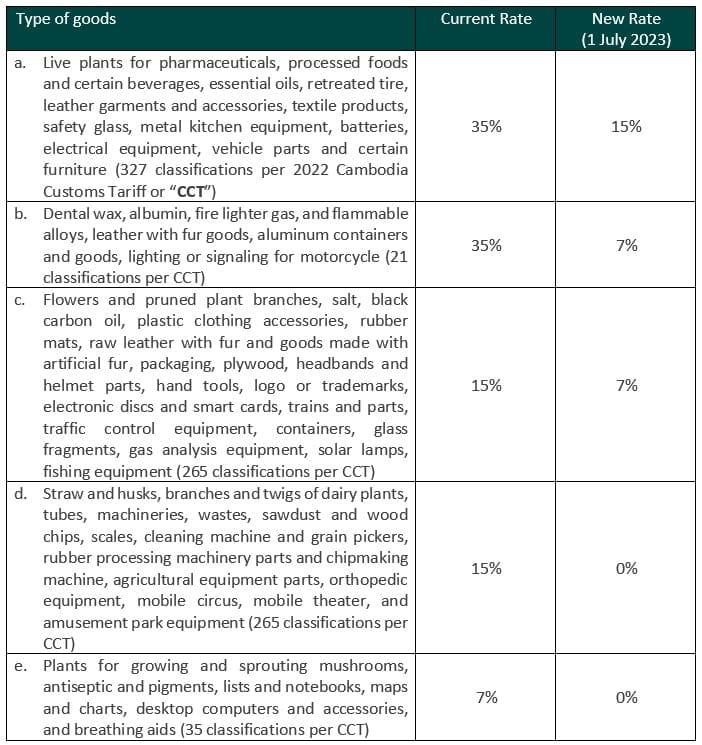

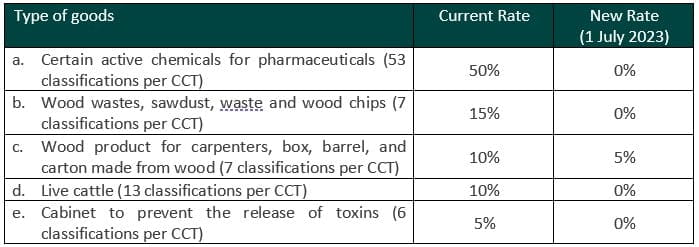

1. Decrease in customs duty rates on certain goods

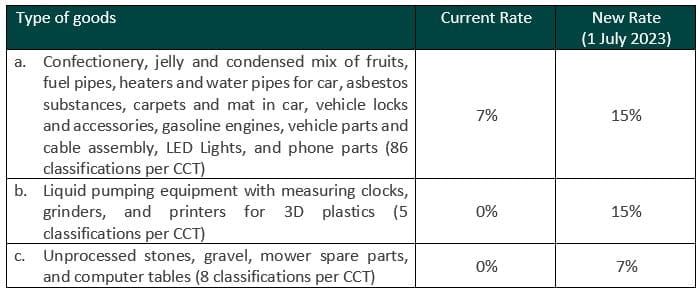

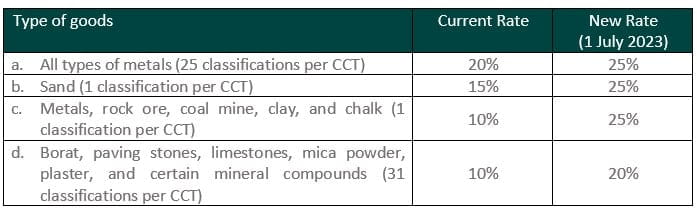

2. Increase in customs duty rates on certain goods

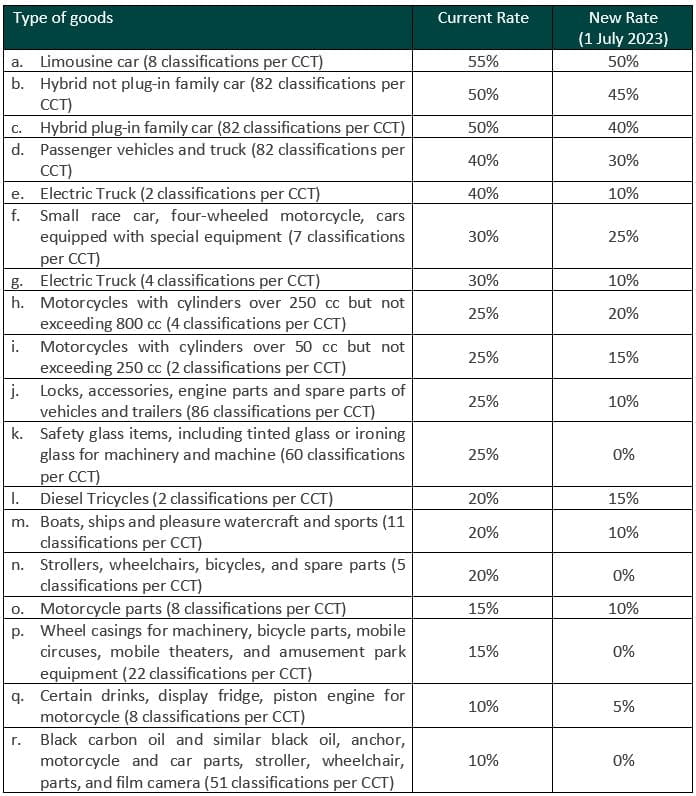

3. Decrease in specific tax on certain imported goods

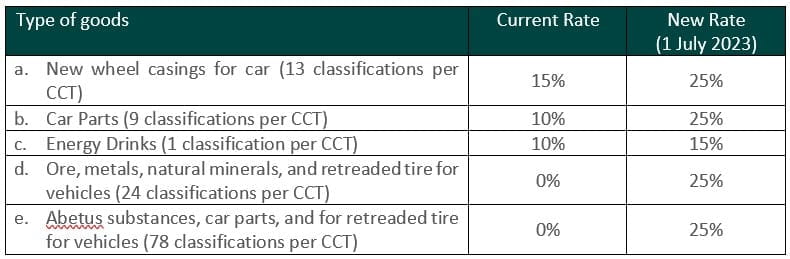

4. Increase in specific tax on certain imported goods

5. Decrease in export tax on certain goods

6. Increase in export tax on certain goods

DFDL Comments:

Most of the tariff adjustments provide tax reductions for certain types of goods. For example, agricultural products, chemicals to be used for pharmaceutical purposes, and vehicles have significant tax reductions – some of these products are exempted from tax starting 1 July 2023. On the other hand, the increase in duties and taxes apply to certain goods such as metals, mineral-related items, vehicle parts, and energy drinks.

While these tariff adjustments will affect the revenue collection of the General Department of Customs and Excise, it is expected that these changes will help reduce Cambodia’s trade barriers and will open more opportunities for exports.

Tax services required to be undertaken by a licensed tax agent in Cambodia are provided by Mekong Tax Services Co., Ltd, a member of DFDL and licensed as a Cambodian tax agent under license number – TA201701018.